Back

5 Feb 2020

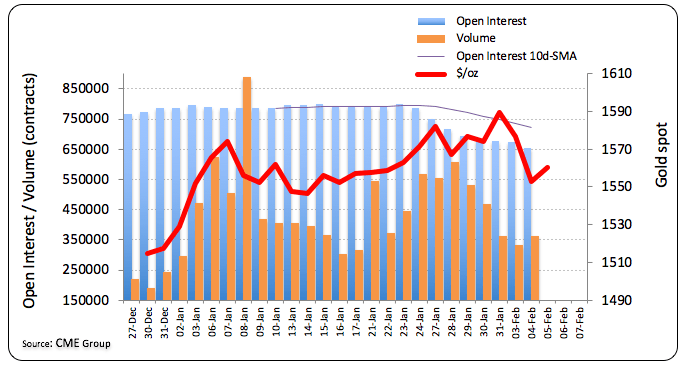

Gold Futures: Rangebound trade should persist

Traders continued to trim their open interest positions in Gold futures markets on Tuesday, this time by around 18.8K contracts, as per flash data from CME Group. It is worth mentioning that open interest has been declining since January 24th. On another direction, volume reversed four drops in a row and increased by around 32.5K contracts.

Gold expected to move sideways

The recent decline in prices of the ounce troy of Gold appears to have met solid contention near the $1550 mark, where sits a Fibo retracement of the December-January rally. Tuesday’s negative price action was on the back of rising open interest and lower volume, signalling that further rangebound should be on the cards in the short-term horizon at least.