Back

14 Mar 2023

Gold Futures: Rally could take a breather

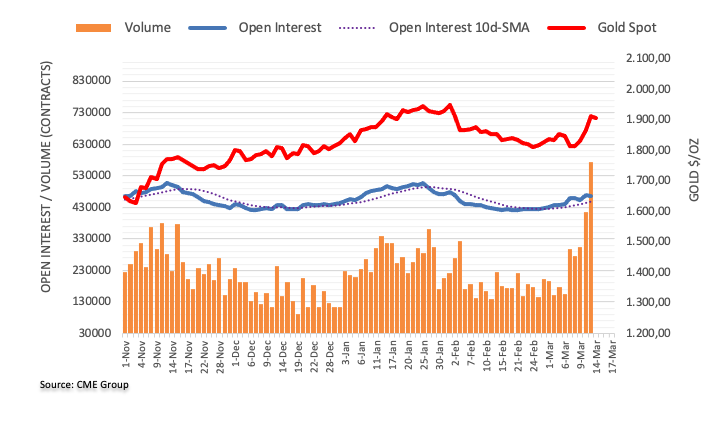

CME Group’s flash data for gold futures markets noted traders scaled back their open interest positions by more than 2K contracts on Monday. Volume, instead, rose for the third session in a row, this time by around 161.5K contracts.

Gold: Next on the upside comes $1960

The auspicious start of the new trading week saw gold prices surpass the key $1900 mark per ounce troy. The acute advance was on the back of diminishing open interest, which hints at the idea that the yellow metal could enter an impasse in the current sharp recovery. So far, the next hurdle of note for bullion emerges at the 2023 high at $1959 (February 2).