Ichimoku Cloud trading strategy explained: how to use it for clear buy and sell signals

The Ichimoku Cloud, also known as Ichimoku Kinko Hyo, is a versatile technical analysis indicator that provides an integral view of the market. Use the Ichimoku Cloud trading strategy to find trends, support and resistance levels, and potential reversal points.

Table of contents

- Trading conditions for the Ichimoku Cloud strategy

- What is the Ichimoku indicator, and how it works

- How to add the Ichimoku indicator to a price chart

- How to use the Ichimoku strategy for trading

- Ichimoku buy signals: best entry points for a long position

- Ichimoku sell signals: best entry points for a short position

Trading conditions for the Ichimoku Cloud strategy

Suitable timeframes: all (up to H6 for scalping)Trading instruments: currency pairs, stocks, indices, commodities, cryptocurrencies

Best currency pairs: all (most often used for JPY pairs like USDJPY)

Required indicators: Ichimoku Kinko Hyo

Trading platforms: OctaTrader, MetaTrader 4, MetaTrader 5

What the Ichimoku indicator is, and how it works

The Ichimoku Cloud indicator was developed by Goichi Hosoda, a Japanese journalist, in the late 1930s. He then spent about 30 years perfecting the trading strategy before making it public in the late 1960s. Its original name, Ichimoku Kinko Hyo, translates from Japanese as ‘equilibrium chart at a glance’, highlighting its ability to provide a quick and informative view of market conditions.Five main components of the Ichimoku Cloud

The Ichimoku Kinko Hyo technical indicator is a collection of five different lines.- Conversion Line (Tenkan-Sen): a short-term moving average calculated from the highest and the lowest prices over the past nine periods.

- Base Line (Kijun-Sen): a medium-term moving average similar to the Conversion Line but based on the past 26 periods.

- Lagging Span (Chikou Span): the closing price with a 26-period lag.

- Lead 1 (Senkou Span A or Leading Span A): the midpoint between the Conversion Line and the Base Line projected 26 periods into the future.

- Lead 2 (Senkou Span B or Leading Span B) a medium-term moving average of the past 52 periods projected 26 periods ahead.

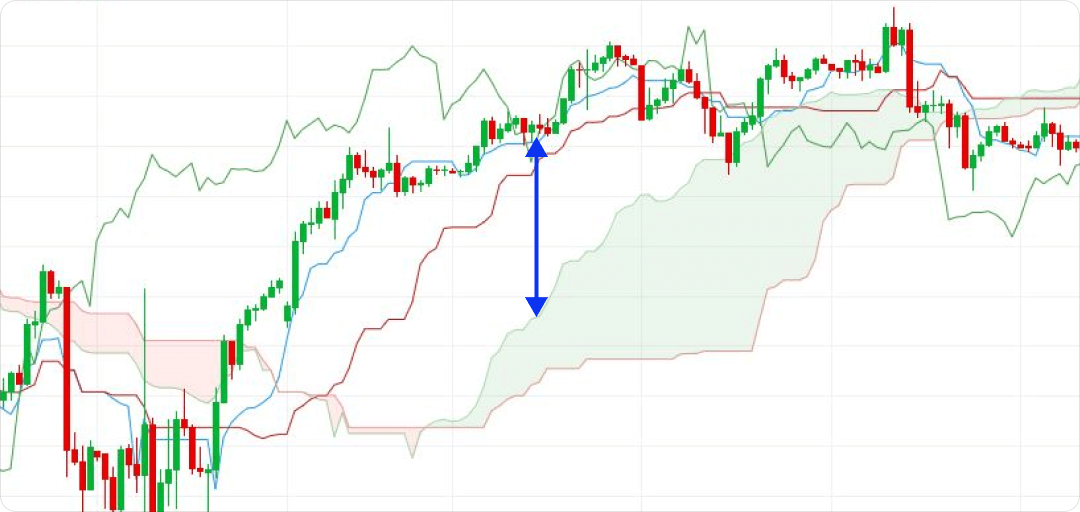

The area between Lead 1 and Lead 2 is called the Cloud (Kumo). It is an essential part of the indicator that might provide valuable insights into support or resistance levels. The area is coloured differently depending on the trend direction. To learn more about how you can use the Cloud to find good trading opportunities, skip to our illustrated examples.

How to add the Ichimoku indicator to a price chart

Setting up Ichimoku Kinko Hyo in OctaTrader

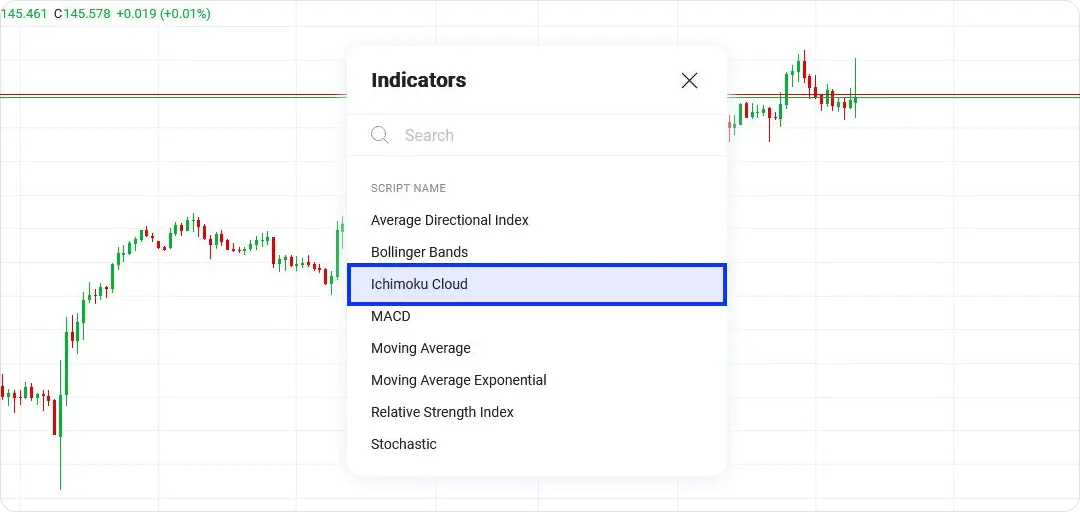

To install the indicator, open OctaTrader and press the Indicators button above the chart window.

In the pop-up window, select Ichimoku Cloud. Then, close the window.

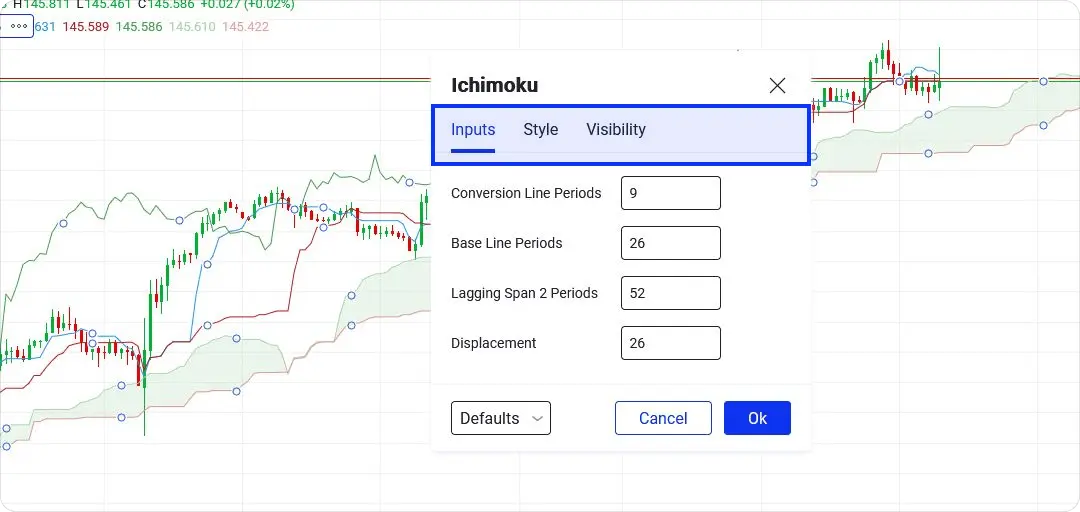

In the OctaTrader trading platform, you can customise all the components of the Ichimoku indicator and change their appearance. Just double-click any line of the indicator and edit its inputs, style, or visibility.

Installing the indicator in MetaTrader 4 and 5

Installing the Ichimoku in MT4 or MT5 is also simple. Open a chart, then go to the Insert tab of the main menu. Press Indicators > Trend > Ichimoku Kinko Hyo. Customise your indicator or press OK to apply the default settings.How to use the Ichimoku strategy for trading

To start using Ichimoku Kinko Hyo for trading, sign up and create a free Octa trading account in just a few easy steps. All you need is a valid email address or a social media account.You can also open a demo trading account with Octa to test or backtest this or any other trading strategy in a real trading environment—but without risking any real money. Use your Octa demo account to improve trading skills and learn new market tricks with unlimited virtual funds.

Using Ichimoku Kinko Hyo to identify trends

One of the primary applications of the Ichimoku trading system is identifying the overall trend of an asset. Before entering a trade, check out how the price chart and the Cloud are positioned relative to one another.If the price is above the Cloud, it supports a long (buy) opportunity.

If the price is below the Cloud, it supports a short (sell) opportunity.

Using the Ichimoku Cloud to confirm trends

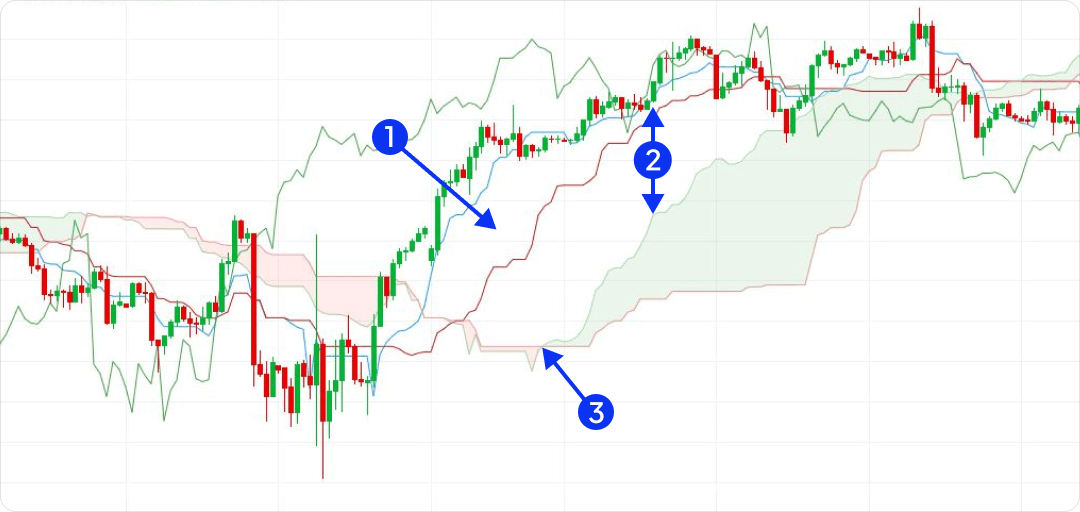

Look for crossovers of the Conversion Line and the Base Line to confirm strong trends and find out which way the market is currently heading.If the Conversion Line consistently remains above the Base Line, it indicates a bullish trend.

On the contrary, if the Conversion Line remains below the Base Line, it suggests a bearish trend.

Using the Kumo Twist to get trading signals

Another critical aspect of the Ichimoku strategy is the Kumo Twist, when Lead 1 and Lead 2 meet.When Lead 1 crosses above Lead 2, it suggests a bullish crossover: the trend is probably heading upwards.

Conversely, when Lead 1 crosses below Lead 2, it indicates a bearish crossover. That means the trend is probably heading downwards.

Ichimoku buy signals: best entry points for a long position

- Conversion Line / Base Line Bullish Crossover: the most straightforward buy signal occurs when the Conversion Line (short-term moving average) crosses above the Base Line (medium-term moving average). This crossover suggests a potential shift towards a bullish trend and can serve as a buy signal.

- Price Above the Cloud: when the price is trading above the Cloud, it indicates a bullish trend. Consider buying the asset when the price pulls back to touch the Cloud or when it breaks above the Cloud after a period of consolidation.

- Kumo Twist Confirmation: when Lead 1 crosses above Lead 2, a Kumo Twist happens, so you can expect a potential bullish trend reversal. Use this signal as a confirmation of a potential shift in the trend to enter a long position.

An additional confirmation for a possible bullish trend is an Ichimoku Bullish Kumo Breakout. If the price consolidates within the Cloud and then breaks above the upper Cloud boundary, it can be a sign of a potential bullish breakout. This breakout can be considered an entry point to buy.

Ichimoku sell signals: best entry points for a short position

- Conversion Line / Base Line Bearish Crossover: the most straightforward sell signal is when the Conversion Line crosses below the Base Line. It suggests an upcoming shift to a bearish trend and can serve as an entry point to sell your assets.

- Price Below the Cloud: when the price is consistently trading below the Cloud, it indicates a bearish trend. Consider it a sell signal when the price pulls back to touch the Cloud or when it breaks below the Cloud after a period of consolidation.

- Kumo Twist Confirmation: when Lead 1 crosses below Lead 2, generating a Kumo Twist, it signals a potential bearish trend reversal. Use this signal as a confirmation of a potential shift in trend to enter a short position.

An additional confirmation for a possible bearish trend is an Ichimoku Bearish Kumo Breakout. If the price consolidates within the Cloud and then breaks below the lower Cloud boundary, it can be a sign of a potential bearish breakout. This breakout can be considered an entry point to sell.

FAQ

How to read the Ichimoku Cloud signals?

The indicator can produce three basic types of trading signals.- Bullish signals: when the Conversion Line crosses above the Base Line, the asset's price may experience an upward trend.

- Bearish signals: conversely, when the Conversion Line crosses below the Base Line, it is a potential bearish signal, and the asset's price may experience a downward trend.

- Cloud signals: when the price is above the Cloud, it indicates a potential bullish (upward) trend, and when it is below the Cloud, it suggests a bearish (downward) trend.